oregon wbf tax rate

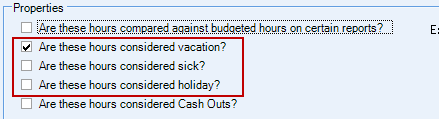

QB incorrectly adds vacation hours and holiday hours to calculate this assessment. The 2022 Workers Benefit Fund WBF assessment rate is 22 cents per hour.

Oregon Payroll Tax And Registration Guide Peo Guide

You are responsible for any necessary changes to this rate.

. Enter a Tax ID. Workers Benefit Fund Assessment Rate Workers Benefit Fund cents-per-hour assessment. 009 00009 for 1st quarter 009 00009 for 2nd.

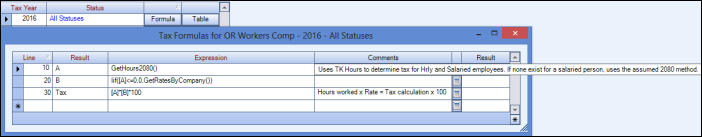

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. OregongovdcbscostPagesindexaspx for current rate notice. What is the 2022 tax rate.

The WBF assessment rate which varies from year to year is xxx cents for each hour or partial hour worked. The Oregon Department of Consumer and Business Services has announced that the Workers Benefit Fund WBF assessment is 22 cents per hour worked in 2022 unchanged. Detailed Oregon state income tax rates and brackets are available on this page.

The Edit Employee window opens. 09 Taxable maximum rate. Self-insured employers and public-sector self-insured employer groups pay 99 percent.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. Oregon workers are subject to Workers Benefit Fund WBF assessment tax. Private-sector self-insured employer groups pay 103 percent.

The Oregon income tax has four tax brackets with a maximum marginal income tax of 990 as of 2022. In the Employee Center double-click on the employees name. 21 in a news release.

Oregon has an additional requirement of Form OR-WR Oregon Annual Withholding Tax Reconciliation Report to be filed only if there is a tax. Enter the tax formula and table rate information. 1 2019 Oregons unemployment-taxable wage base is to be 40600 up from 39300 for 2018 the state Employment Department said Nov.

Box 4D Use the current LTD tax rate. For example The 2017-2018 rate is 28 cents for each hour or partial hour and. Employers and employees split this assessment which employers collect through payroll.

For calendar year 2016 the rate is 33 cents per hour this rate has not changed for several years. Tax Formula Set Up. The 2022 payroll tax schedule is a.

54 Taxable base tax rate. Workers Benefit Fund Payroll assessment Special benefits for certain injured workers and their families and return-to-work programs. Click the Payroll Info tab.

Wbf assessment for Oregon is based on the number of hours that an employee works. Click the Taxes button to display the Federal State. This assessment is calculated based on employees per hour worked.

Unemployment tax rates for employers subject to Oregon payroll tax will move to tax schedule three for the 2022 calendar year. For 2022 the rate is 22 cents per hour. 24 new employer rate Special payroll tax offset.

Go online at httpswww. 22 cents per hour worked. The Department of Consumer and Business Services has set the WBF assessment rate for calendar year 2021 at 22 cents per hour.

Enter a Tax ID. Remains at 98 percent in 2023. What is the Oregon WBF tax rate.

Enter the tax formula and table rate information.

Oregon State Workers Comp Form 801 Fill Out Sign Online Dochub

Oregon Workers Benefit Fund Payroll Tax

Mens Nike Air Force 1 Low Wbf World Basketball Festival Pack China Size 9 Yellow Ebay

Proposed Oregon Business Tax And Personal Income Tax Rate Reduction

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Department Of Consumer And Business Services Charts Oregon Workers Compensation Costs State Of Oregon

Form Oq Inst Fillable Amended Report Instuctions

Oregon Combined Payroll Tax Report Pdf Free Download

Oregon Payroll Tax And Registration Guide Peo Guide

Oregon Transit Tax Update Available Now Datatech

Frequently Used Screens In Ospa Oregon Statewide Payroll Services Ppt Download

Oregon Workers Benefit Fund Payroll Tax

Form Oq Fill Out Sign Online Dochub

Ernst Young Finds Oregon Has Nation S Lowest Total Effective Business Tax Rate Oregon Center For Public Policy

Oregon Workers Benefit Fund Payroll Tax

Workers Compensation Market Characteristics Report

What Is The Oregon Transit Tax Statewide Local

Oregon Domestic Combined Payroll Tax Report Oregon Department Of Revenue Pdf Free Download